Scottish Mortgage Investment Trust (LSE: SMT) shares are down 28% in the last year. Over an 18-month period, they’ve shed over half their value!

What on earth’s going on here?

Time horizons

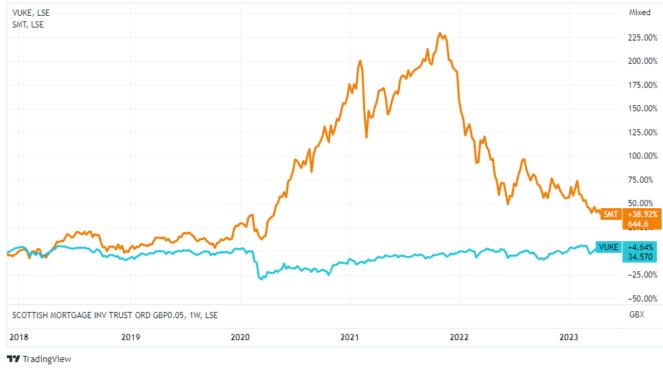

In terms of assessing performance, the trust’s managers explicitly ask investors to judge this over a five-year rolling period. On this front, the share price has significantly outpaced Vanguard’s FTSE 100 index tracker fund (VUKE) over the last half a decade.

Should you invest £1,000 in Scottish Mortgage right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Scottish Mortgage made the list?

However, Scottish Mortgage’s portfolio only contains one FTSE 100 stock (retail technology firm Ocado), so that’s not really a fair comparison.

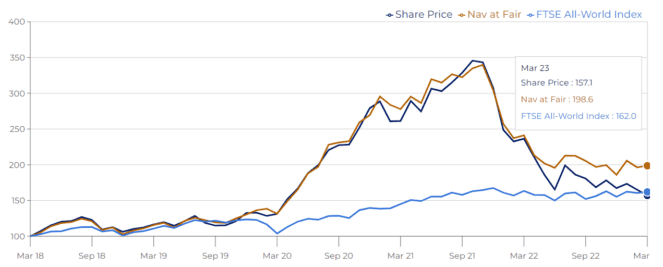

The benchmark the trust’s returns are actually compared against is the FTSE All-World Index. And the share price is now marginally trailing this index over a five-year period.

This is rare for Scottish Mortgage, as it has a long history of outperformance. That said, it is beating its benchmark on an underlying basis. It’s just that the shares are trading at a 20% discount to the net asset value (NAV) of the trust.

Why is there a discount?

The share price of an investment trust can differ from its underlying NAV. If it’s above the NAV, the investment trust is said to be trading at a premium. On the flip side, when the share price is below the NAV, this is known as a discount.

Essentially then, the discount means that Scottish Mortgage shares have fallen out of favour with investors. And this has happened for a couple of reasons.

First, as interest rates have risen steeply, there’s been a general market rotation away from the sort of high-growth stocks owned by the trust. That’s because higher interest rates make the future cash flows of growth companies less valuable.

The bottom line is that bonds compete with stocks as potential investments. And bonds (which promise a fixed return) have now become more attractive than growth stocks (where the future pay-offs are often far from certain).

Second, the market fears that the valuations of the trust’s unlisted companies are still too high. They could have further to fall, which is certainly possible.

Reasons for optimism

Despite all these concerns, I think there are reasons to be optimistic looking forward.

I reckon interest rates could peak this year, which would be beneficial to stocks. That’s why Goldman Sachs is predicting 2024 will be a bumper year for tech companies going public.

Consequently, some of the trust’s large private holdings may go public. Possible candidates include TikTok owner ByteDance, digital payments firm Stripe, and European electric battery producer Northvolt. These blockbuster initial public offerings could reignite interest in Scottish Mortgage.

Plus, many of the companies in the portfolio continue to make exceptional progress. Moderna is demonstrating that its mRNA technology may be applicable beyond Covid to diseases such as HIV and cancer. Meanwhile, SpaceX successfully launched 61 rockets last year (almost double compared to 2021).

Finally, it was reported last month that hedge funds have started closing their short positions against Scottish Mortgage shares. This suggests that these elite money managers think the share price might be near a bottom.

I’m actively adding to my Scottish Mortgage holding for the first time in three years. That 20% markdown is too hard to ignore!